The primary goal of most mortgage lead generation websites is to generate a consistent flow of exclusive mortgage leads. Mortgage Lead Conversion is the third of three steps in Internet Mortgage Lead Generation. Before mortgage lead conversion and mortgage lead generation can take place, there first two components of Internet Mortgage Lead Generation must be satisfied:

1 Search Engine Optimized Mortgage Website

A mortgage web site that has been optimized for relevant mortgage keyword terms being used by the target audience. An SEO optimized mortgage website will build high search engine rankings over time and help generate traffic. A mortgage website or mortgage template website is also important to any mortgage campaign as it is the hub of all mortgage marketing activities online and off. When prospects see mortgage marketing or advertising, the first place they go is to the website, this means that a mortgage website not only helps generate more internet mortgage leads from online SEO activities, but directly helps convert more prospects from offline mortgage marketing activities into exclusive mortgage leads.

2 Website Traffic

Traffic is generated from existing relationships and offline mortgage broker marketing activities such as direct mail, flyers, radio, tv and other mortgage marketing activities. Internet marketing campaigns such as pay per click or banner advertising will also drive traffic to your mortgage web site.

Traffic is generated from existing relationships and offline mortgage broker marketing activities such as direct mail, flyers, radio, tv and other mortgage marketing activities. Internet marketing campaigns such as pay per click or banner advertising will also drive traffic to your mortgage web site.

Organic search engine ranking will also help drive traffic to your web site. Creating unique content on your website and then generating links to that content to improve search engine rankings will also increase visitor traffic and search engine rankings.

Once the first and second components of mortgage lead generation have been satisfied, on-page website conversion can take place.

3 Conversion of Website Visitors

Conversion is the ability to convert visitors to your mortgage broker website into online mortgage leads via a contact form, live chat or a direct phone call to you. The primary tool employed on a mortgage lead generation website is the online application or rate quote / information request. You have invested money and time building and promoting your brand and website, so it is very important that you have the right tools in order to achieve the highest level of conversion on your website possible.

The Right Tools For the Job

The hands down most important on-page conversion factor issue facing mortgage companies today on their mortgage websites is the quality of their online mortgage applications. The mortgage website industry has long been steering their customers in the the wrong direction by promoting a “Online Full 1003 Application” or “Full 1003” application style.

Originally designed to be a tool of efficiency that kept a loan officer from needing to take a loan application over the phone or in person, the Full 1003 style mortgage application has long since been proven to be a non-starter as borrowers will not fill it out due to its length and complexity.

Mortgage Lead Generation Killer: The Full 1003 Application

The “Full 1003” is bad, very bad. It does not convert visitors to mortgage leads and even worse, it will cause your significant harm in the form of lost business and online conversion from visitors you have worked hard to drive to your mortgage website. It is important to note that all of your mortgage marketing campaigns (direct mail, radio, tv, etc.) are affected by this issue because many visitors to your mortgage web site come directly from non-internet related marketing activities. If your your mortgage website employs a Full 1003 application form, you simply will not realize any significant or meaningful success in your lead generation efforts until the Full 1003 Application is removed from your mortgage company website.

Barriers to Mortgage Lead Conversion

Another important aspect of online mortgage website lead conversion is providing as few barriers as possible between website visitors and your online mortgage applications. Case in point: Most mortgage website website design company’s websites take visitors to an intermediary page once a visitor clicks on an “Apply Now” link. This intermediary page typically includes 3 to 5 different options for applying such as “Short Form”, “Long Form”, “Download the Application”, etc. Each of these options includes a two or three sentence summary which then requires the visitor to study each option in order to find out which potential way of submitting an application is most appropriate. This is one more hoop the visitor is made to jump through and will only result in a high rate of application abandonment and guaranteed lower conversion. This intermediary page, combined with a Full 1003 is a proven formula to lower or eliminate lead generation on your mortgage broker web site, yet it is the industry standard model. If you already have a website with any of the major mortgage website providers you know this first hand.

What Works?

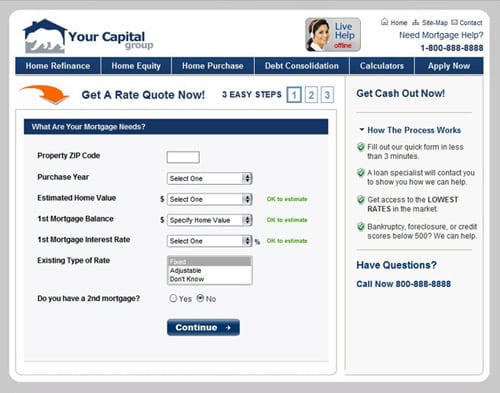

To find out which Online Lead Application does work, you only need to look to the large multi-million dollar companies that generate mortgage leads day in and day out as their core competency such as lowermybills.com, mortgageloan.com, etc. As witnessed on their websites, the 4 page short form application is the form used exclusively by virtually all of these lead generators and top producing mortgage broker and loan officer websites. These companies spend large sums of money driving traffic to their websites, so employing the highest converting online mortgage application possible has become an ongoing quest since day one. Through years of extensive A / B testing, the 4 page short form mortgage application has been proven day in and day out as the highest converting application format available.

In addition to the application format, website architecture, layout, presentation, and content also play an important role in generating online mortgage leads. More specifically, to maximize conversion a website must be authoritative, must provide ample opportunities to gather leads, must be a resource for visitors with useful information and tools, and must have high converting application forms.

The 3 Page Short Form Mortgage Application

- Proven Short Form Mortgage Application

- Advanced Short Form Exclusively Offered By LeadPress

- US Zip Code Database Validates All Property Address Information

- Every LeadPress Website Include Zip Code Database and Short Form

- Data Auto Population Based On US Zip Code

- Full Data Validation Throughout

- All Websites Hosted on Hardened Secured Servers With Nightly Backups

- High Converting Format

Sample High Conversion Mortgage Rate Request

About The Author: Trace

My name is Trace and I’m the founder of LeadPress and an entrepreneur specializing in web development and lead generation. In another life I was a California Real Estate Broker and an Equities Trader holding the Series 7, 63, 55 and 24 Securities Licenses.

More posts by Trace